Hello, I'd really like to grow this email list. If you enjoy this newsletter, it would mean the world to Jola and I if you encouraged one friend/fellow immigrant/colleague to subscribe…Very likely, the the only thing you will get in return is warm fuzzy feelings, and if I can attribute it to you, I’d personally send you a thank you email.

Bonuses. I love them. They often come at the best times, like when you’re wondering how to fund your significant other’s birthday party or when your role as an uncle means the Christmas gift list keeps growing yearly.

If you’re like me, the taxes on bonuses never seem to make sense. One day it’s X%. The next time it’s 2X%. Gosh, eventually I stopped bothering. I’ll take whatever I see in there.

So, I asked Jerry, friend, fellow immigrant, but one who understands the Canadian tax system better than me, about how our bonuses are taxed in Canada (cos I assume you wanna solve this mystery once and for all, right?).

Jerry, take it away.

To Understand Taxes on Bonuses, We Need to Understand Tax Rates

For the average person who may not understand how taxes are calculated or be interested in finding out, taxes can be complicated. It can be frustrating that taxes significantly reduce our pay after working hard. If the reward for hard work comes at “half” the price, it can feel unfair. Nonetheless, understanding the basics of taxes is key to unlocking wealth in a progressive economy like Canada.

To explain taxing bonus payments, we need to understand average and marginal tax rates.

The average tax rate of an income is calculated by dividing the total income by the total tax paid. For example, if an individual earns $100,000 per year and pays $10,000 in taxes, the average tax rate is 10%. The marginal tax rate is the tax rate on the next dollar of income earned, meaning the rate on each additional dollar may not be the same.

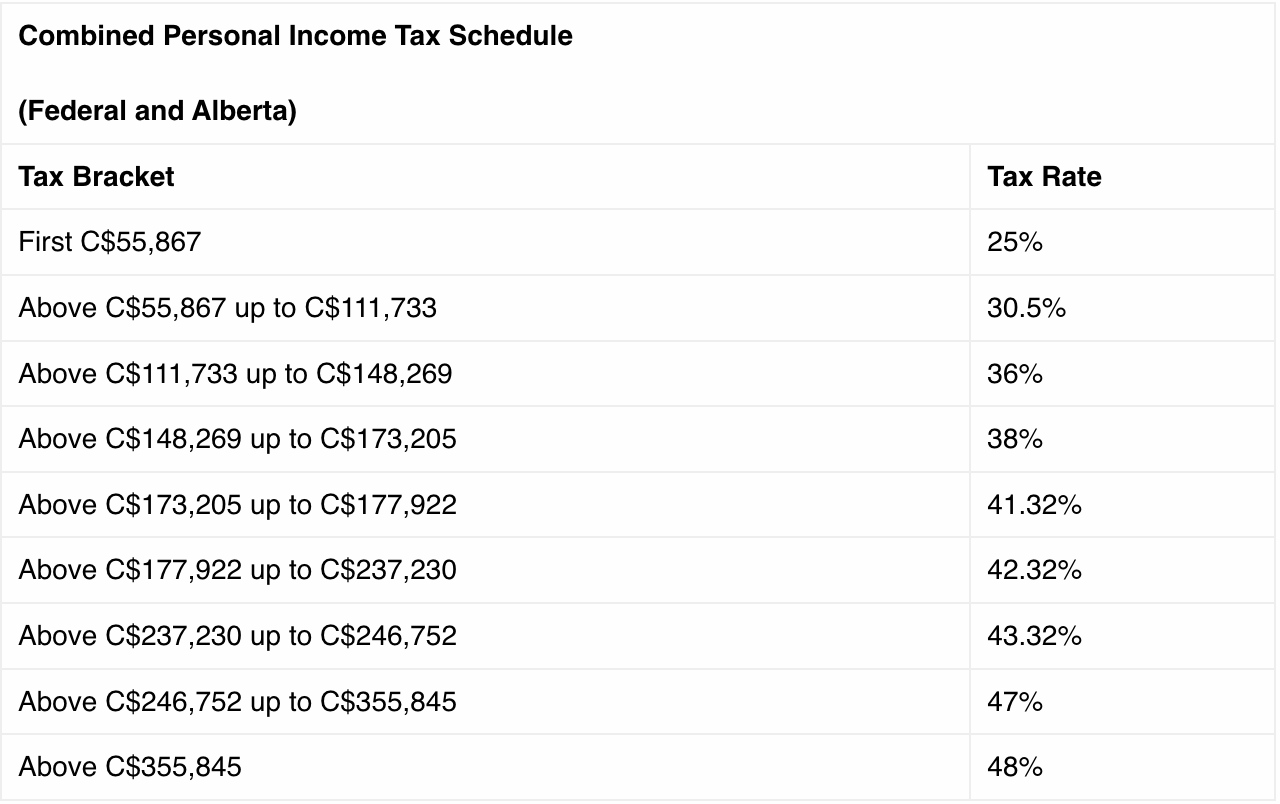

Canada uses a progressive tax system, meaning tax rates increase with income. This applies at both federal and provincial levels.

For a $100,000 income, the federal tax would be 15% on the first $55,867 and 20.5% on the remaining $44,133, resulting in an approximate tax rate of 17%. This shows a 7% increase compared to the earlier rate of 10%.

This is also how our bonuses are taxed, but there’s a twist.

In a fixed-hour, fixed-pay situation, the income due to an employee by an employer is known and agreed upon from the start of the employment contract.

The tax deducted from each pay is typically fixed, so the take-home pay is almost guaranteed to be the same. Meanwhile, bonuses are typically a percentage of one’s pay and are determined by factors like company profitability and employee performance.

Taxes owed from a bonus payment can’t be factored in until paid. Now, this is where it gets interesting.

To determine the tax on the bonus, your employer will add the bonus to your salary, then subtract that from the tax on just the salary. However, because this will likely push the individual into a higher tax bracket, the tax rate on the bonus is often higher.

Everything seems clearer with figures, so let’s break this down using our previous example.

Income at C$100,000:

Additional C$20,000 bonus during the year:

The tables show that the total tax on an annual income of $100,000 increases by around $6,500 due to a $20,000 bonus. This difference amounts to the tax on the bonus.

When taken in isolation, a $6,500 deduction on a $20,000 pay amounts to a 33% tax rate, which seems too high for a $20,000 pay.

This is just the income tax. Other deductions like CPP and EI premiums could also be deducted from your bonus if the maximum deductible amounts for the year haven’t been reached.

These deductions explain why your net bonus varies or looks smaller sometimes.

Helpful?